Website Product Disclosures for Financial Products that Promote Environmental or Social Characteristics

Summary

The Natural Ventures Impact Fund (“the Fund”) is an impact venture capital fund that promotes environmental and social characteristics by investing in and supporting innovative technologies to address many of the world’s water and food security challenges. The Fund will exclude from investment companies engaged in particular business activities or behaviour which are harmful to environmental or social objectives.

The Fund implements a proprietary ESG and Impact Framework which embeds ESG and impact management into every step of the investment process from basic screening to deal finalisation, as further particularised in the section titled “Methodologies” below.

A minimum of 80% of the Fund’s investments will be in companies that promote environmental and social characteristics, as further particularised in the section titled “Environmental or Social Characteristics of the Financial Product” below. The Fund will not make indirect investments.

The Fund implements a structured due diligence process and generally obtains information and data directly from portfolio companies given that the Fund only invests into privately-held businesses. Therefore, the Fund is dependent on the quality of information provided and will confirm the accuracy of information through its due diligence process.

The Fund will agree ESG action plans with company management and will require portfolio companies to report annually on ESG and impact KPIs to monitor their performance on an ongoing basis. The Fund will engage directly with portfolio companies and may require them to take corrective measures.

No Sustainable Investment Objective

This financial product promotes environmental or social characteristics, but does not have as its objective sustainable investment.

Environmental or Social Characteristics of the Financial Product

Promotion of Environmental and Social Characteristics

The Fund promotes environmental and social characteristics by investing in early-stage technology companies which are active in the water and food security sectors which seek to generate a positive and measurable environmental impact by providing water efficiency and food security solutions (“Impact Investments”). The Fund also promotes environmental and social characteristics by applying a basic screening which excludes from investment companies engaged in particular business activities or behaviour which are harmful to environmental or social objectives including companies referred to in Article 12(1)(a) to (g) of Commission Delegated Regulation (EU) 2020/1818 (the “Exclusion List”).

Sustainability Indicators

The sustainability indicators used to measure the attainment of the environmental and social characteristics promoted by the Fund are:

- The percentage of the Fund’s holdings in Impact Investments.

- The percentage of the Fund’s holdings which comply with the Exclusion List.

Impact Investments

Impact Investments are defined by our ESG and Impact Framework as at the point of investment and monitored on an ongoing basis. For further information on our ESG and Impact Framework, please see the section titled “Methodologies” below.

Exclusion List

The Fund will not make any investment in any company:

- Which engages in production or trade of any product or activity deemed illegal under host country laws or regulations or international conventions and agreements.

- Which has operations in, or trades with, countries involved in terrorist activities or severe human rights violations.

- Which is the subject of a public investigation or legal action based upon a suspected relationship with serious criminal or terrorist activities.

- Which is materially and immitigable harmful to the environment and/or human life, via i) the intended use of its products or via ii) its supply chain.

- Which is involved in one of the following industries: tobacco, gambling and/or weapons.

The Fund will also not make any investment in any company referred to in Article 12(1)(a) to (g) of Commission Delegated Regulation (EU) 2020/1818:

- Companies involved in any activities related to controversial weapons.

- Companies involved in the cultivation and production of tobacco.

- Companies that benchmark administrators find in violation of the United Nations Global Compact (UNGC) principles or the Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises.

- Companies that derive 1 % or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite.

- Companies that derive 10 % or more of their revenues from the exploration, extraction, distribution or refining of oil fuels.

- Companies that derive 50 % or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels.

- Companies that derive 50 % or more of their revenues from electricity generation with a GHG intensity of more than 100 g CO2 e/kWh.

Together, these two sets of exclusions form our Exclusion List.

Investment Strategy

Binding Elements of the Investment Strategy

The Fund follows an ESG and impact investment strategy by focusing on investing in early-stage and growth-stage technology companies in the water and food security sectors. For further details, please see the section titled “Methodologies” below.

The binding elements of the investment strategy used to select the Fund’s investments are:

- A minimum of 80% of the Fund’s investments will be Impact Investments in accordance with its ESG and Impact Framework.

- The Fund will not make any investment into companies not in compliance with the Exclusion List.

The Fund excludes investments in accordance with the Exclusion List. However, the fund does not commit to a minimum rate to reduce the scope of the investments considered prior to the application of its investment strategy.

Good Governance Policy

The Fund assesses good governance practices of investee companies through the propietary ESG checklist used during ESG due diligence which addresses sound management structure, employee relations, remuneration of staff and governance-related reputational risk issues.

Proportion of Investments

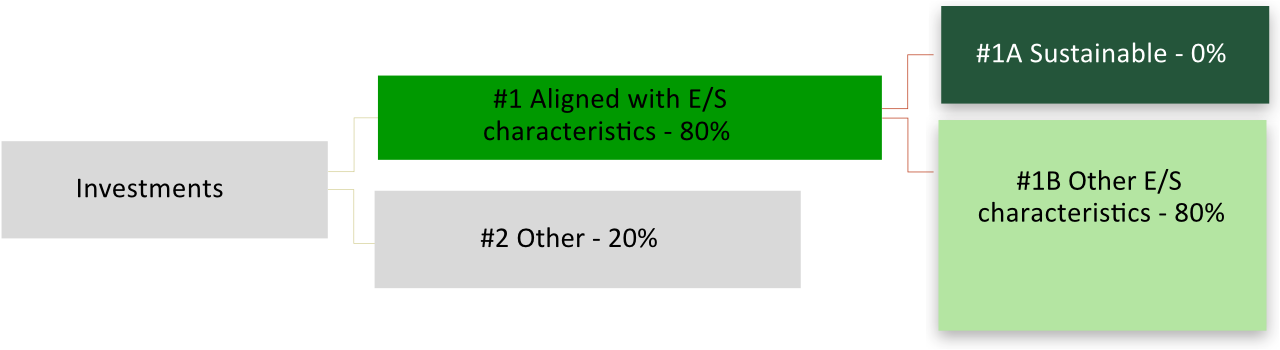

The minimum proportion of investments used to meet the environmental and social characteristics promoted by the Fund is 80% (#1 Aligned with E/S characteristics). As a result, a maximum proportion of 20% of the Fund’s assets will be categorised as “#2 Other”.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

The category #1 Aligned with E/S characteristics covers:

– The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

– The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

The Fund will not make indirect investments.

Monitoring of Environmental or Social Characteristics

On an ongoing basis and no less than annually, the Fund will monitor its investments in accordance with the ESG and Impact Framework to ensure the ongoing promotion of environmental and social characteristics. The Fund will request information from its investments to support this monitoring and the Fund may directly engage with its investments to conduct monitoring where appropriate.

The Fund will require its portfolio companies to report ESG and impact KPIs agreed with them as set out in Shareholders Agreements.

Methodologies

ESG and Impact Framework

The Fund embeds ESG and impact management into every step of the investment process from basic screening to deal finalisation. The steps of the investment process are summarised below.

- Basic screening: the analyst team investigates whether the prospective investments will contribute to a more sustainable water environment.

- Further analysis: the analyst team identifies potential ESG issues applicable to the potential portfolio company.

- Term sheet: the investment team engages with the management teams of the potential portolio company to discuss its ESG principles and what it expects all portfolio companies to commit to.

- Due diligence: the investment team conducts ESG due diligence, either internally or using an external provider. This involves using a proprietary ESG checklist, previously conducted risk classification and engagement with the prospective portfolio company’s management team. The investment team aims to identify control measures to mitigate any identified ESG risks and formulates actionable conditions in the form of an action plan. These actions are to be validated by the portfolio company’s management team. Additionally, the investment team will assess the portfolio company’s capacity and level of ambition to manage these risks, ensuring they have, or will have, the necessary policies and procedures in place to do so. Finally, during the due diligence process, the investment team establishes 1-5 environmental KPIs, in collaboration with with the portfolio company’s management team, which are to be tracked annually.

- Investment proposal: using the results from the steps described above, a specific ESG and impact section is drafted for inclusion in the investment documentation to be approved by the impact officer.

- Finalise deal: the Fund includes specific clauses in the Shareholder Agreement to ensure the portfolio company will meet the previously agreed requirements, collect the relevant data for the agreed KPIs and implement the agreed actions to mitigate identified ESG risks.

- Ongoing ESG and impact Management: portfolio managers will update ESG scoring and key focus areas with the portfolio company’s management team on a quarterly basis while progress towards the action plan and environemntal KPIs are reviewed annually.

Data Sources and Processing

The Fund will conduct its own due diligence to gather necessary data on investments as part of the investment process. The Fund will seek to ensure the quality of data gathered by engaging investments directly. Data that is gathered will be considered as part of the steps set out in our ESG and Impact Framework. Generally, data that is gathered directly from investments is not estimated although where data is not available the Fund may estimate data if it is reasonable to do so.

Limitation to Methodologies and Data

Since the Fund will invest in privately held companies or assets, there is usually no publicly available data to use as part of the investment process which means the Fund relies on the accuracy and completeness of data provided by investments. Nonetheless, as part of the due diligence process the Fund will seek to confirm the accuracy and completeness of data provided. Therefore, it is not expected that data limitations will affect the promotion of environmental and social characteristics.

Post-investment, the Fund will continue to monitor its investments and may engage with the board of directors or senior management to ensure the ongoing promotion of environmental and social characteristics.

Due Diligence

The Fund will conduct due diligence in accordance with our ESG and Impact Framework on companies prior to making an investment. Due diligence can be based on an ESG checklist, the results of the ESG risk classification, sector issue identification, a visit and conversations with company management and other sources of relevant information.

During the DD phase, the investment team will usually determine between 1-5 impact KPIs which are to be tracked by the portfolio company on an annual basis. This is done based on our ESG and Impact Framework, and in collaboration with company management so that we ensure that the metrics make sense to them, and do not place an unnecessary burden on management. In certain cases we may determine specific KPIs which are not yet included in the Framework, if the situation so requires.

Based on the findings of the ESG due diligence, the Fund will consider necessary ESG risk management, prevention, control and mitigation measures to prevent and mitigate the impacts of the identified ESG risks. The investment team will assess the company’s ability and ambition to adequately manage and mitigate the identified ESG risks and will formulate an action plan with concrete and actionable conditions for company management, including a responsible person, action and timeline. The results of the due diligence must be validated by company management.

The investment team will identify the control measures that have been implemented by company management to prevent and/or mitigate the identified ESG risks so far.

Engagement Policies

The Fund will engage with the board of directors or senior management on sustainability-related performance. The investment team will agree to a company-specific action plan with company management to manage and mitigate ESG risks and will monitor progress of the plan. The Fund may request corrective action regarding sustainability risks or impacts to ensure the promotion of environmental and social characteristics.